Market predictions are foolish. All of us discovered this a very long time in the past. However that doesn’t imply they’re fully nugatory. Despite the fact that forecasts are nearly at all times improper, they are often entertaining and academic. That’s all I’m attempting to do with this submit. Entertain and educate. Evidently, however I’ve to say it anyway, nothing on this checklist is funding recommendation. I’m not doing something with my portfolio based mostly on these predictions, and neither must you.

Right here is my checklist from a yr in the past. I bought some proper and lots improper, which is hardly a shock. I count on my predictions to have a horrible monitor report, and that’s why I attempt to experience the market reasonably than outsmart it. So why am I doing this? Nicely, it’s enjoyable to look again on what you thought was doable a yr in the past. If you see that you just had been so off on some issues, it reminds you simply how troublesome it’s to foretell the longer term. I additionally be taught lots by doing this. I uncovered some issues that I didn’t know or forgot I knew. So with that, these are my ten predictions for 2023.

- Bonds maintain their very own as a diversifying asset

- Tech continues its layoffs

- Jeff Bezos returns to Amazon

- The IPO market stays frozen

- Worth Outperforms Progress Once more

- Gold makes a brand new all-time excessive

- The Housing Market Doesn’t Crash

- Worldwide Shares Outperform

- Bitcoin good points 100%

- Vitality shares proceed to outperform

- Bonus. The market avoids a recession, and shares achieve double digits.

Bonds maintain their very own as a diversifying asset.

I’m normally of the opinion that even when you got the information prematurely, you wouldn’t understand how the market would react. 2022 was the exception. Should you knew forward of time that inflation would do what it did, and that the Fed would elevate charges seven occasions to fight it, you’ll have gotten numerous issues proper.

Inflation is poison for bond buyers for 2 causes. It inflates away the worth of the fastened revenue, and it crushes the value of that instrument as rates of interest rise alongside client costs. Final yr was brutal for the bond market, and to make issues worse, that occurred throughout a yr when shares additionally bought creamed. U.S. bonds have traditionally performed nicely when shares bought dinged however final yr proved as soon as once more that only a few iron legal guidelines exist in finance. This isn’t physics.

The common annual return for bonds since 1976 when the S&P 500 fell on the yr (N=8) was 6.7%. Bonds had been optimistic yearly shares fell aside from final yr when rising yields (decrease bond costs) together with increased costs drove shares decrease.

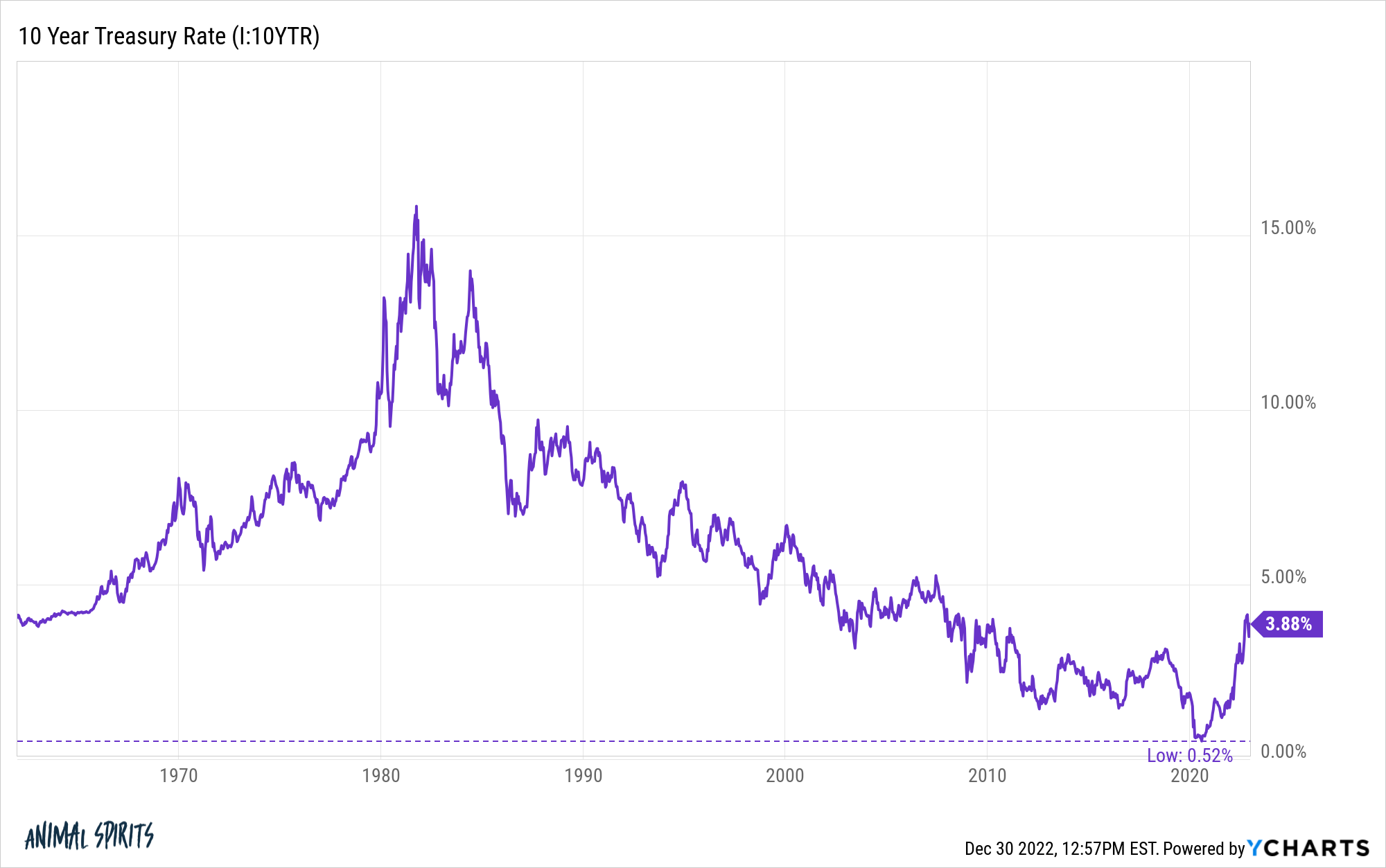

The ten-year treasury went from an all-time low in 2020 to the best ranges in over a decade in pretty brief order. That was painful, however the excellent news is we bought it over with. You possibly can’t go from 50 foundation factors to 4% once more subsequent yr. So, if shares have one other rocky yr, bonds ought to do okay. Even when rates of interest had been to rise, decreasing costs, not less than we’ve bought the fastened revenue element to cushion the blow.

Tech continues its layoffs

When Fb purchased Instagram for $1 billion, the corporate had simply eleven staff. Practically a decade later, it’s pushing 20,000. ‘

One of the vital spectacular components of the increase in know-how over the previous decade is the quantity of income that flowed by to the underside line. That every one modified in 2022, as outlined on this fascinating thread from Jesse Livermore. He reveals that the underperformance of FANMAG was largely a results of revenue margin compression. With the explosive progress in headcount over the previous couple of years, the layoffs in tech that we heard about in 2022 will proceed into 2023 in any respect ranges, from startups to incumbents.

What Elon Musk did at Twitter will work as a blueprint for 2023. It gained’t be as excessive as what he did, however it will likely be a inexperienced gentle for different corporations to observe comparable steps. Final yr, 1,013 tech corporations laid off 153,160 staff. That development will proceed in 2023.

Jeff Bezos returns to Amazon

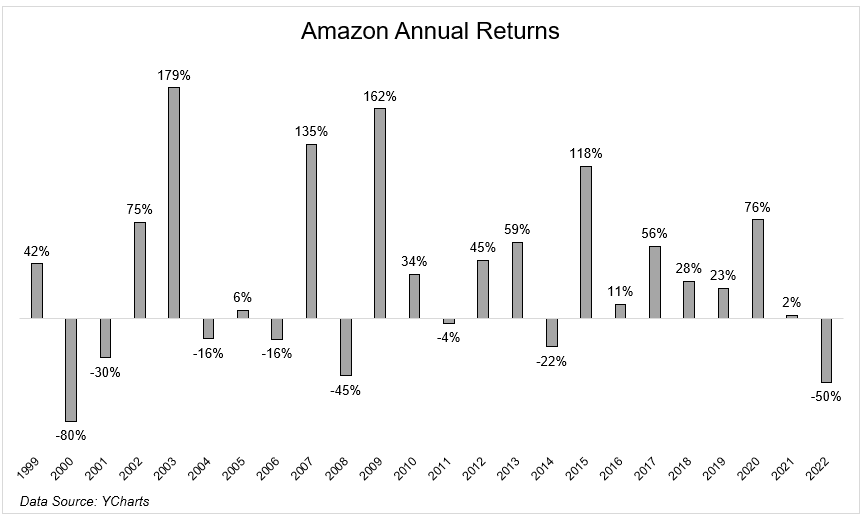

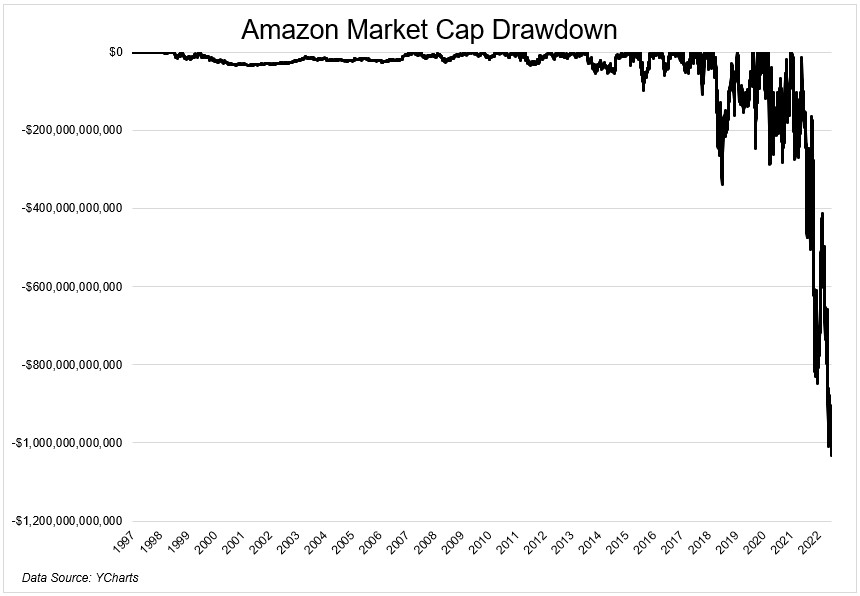

Amazon skilled its largest share value decline on an annual foundation because the dot-com bubble burst.

Sure, Amazon has seen worse drawdowns, however when it peaked through the dot com bubble on its solution to a 90%+ decline, it had a market cap of $36 billion. It misplaced greater than $30 billion on a number of days in 2022 and shed $840 billion this yr alone. It’s exhausting to check this firm to what it was again then.

Jeff Bezos spent 27 years at Amazon and has been gone for lower than two. In 2023 he pulls a Bob Iger and returns to regular the ship.

Worth Outperforms Progress Once more

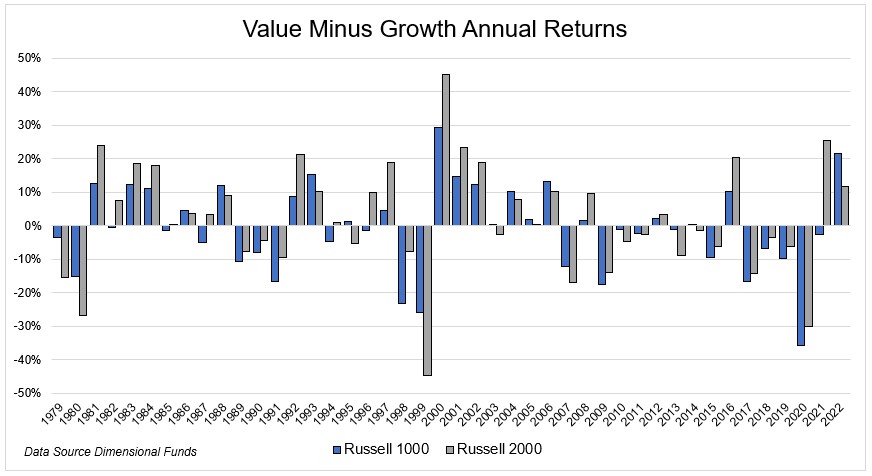

After a decade plus within the doldrums, worth shares shined brilliant in 2022. I didn’t bear in mind this, however small worth dominated small progress in 2021, posting the most important yr or outperformance because the dot-com bubble burst.

Whereas the outperformance of small worth over small progress is close to an all-time excessive, its large-cap brethren nonetheless have a methods to go. This development continues into subsequent yr.

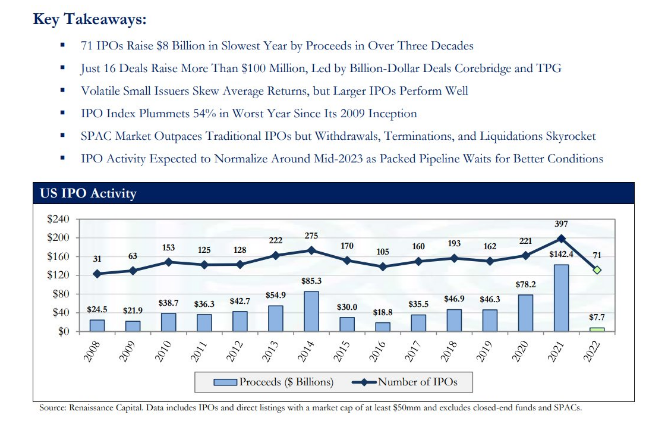

The IPO market stays frozen.

Solely 37 corporations went public in 2022, elevating a paltry $7 billion. That is the weakest exercise because the $4.3 billion raised in 1990 and a 94% collapse from the earlier yr.

There have been fifteen tech IPOs that raised $1 billion in 2021. That quantity went to zero in 2022. That quantity will stay at zero in 2023. It’s exhausting to produce the market with dangerous property when there may be little urge for food for threat.

Gold makes a brand new all-time excessive

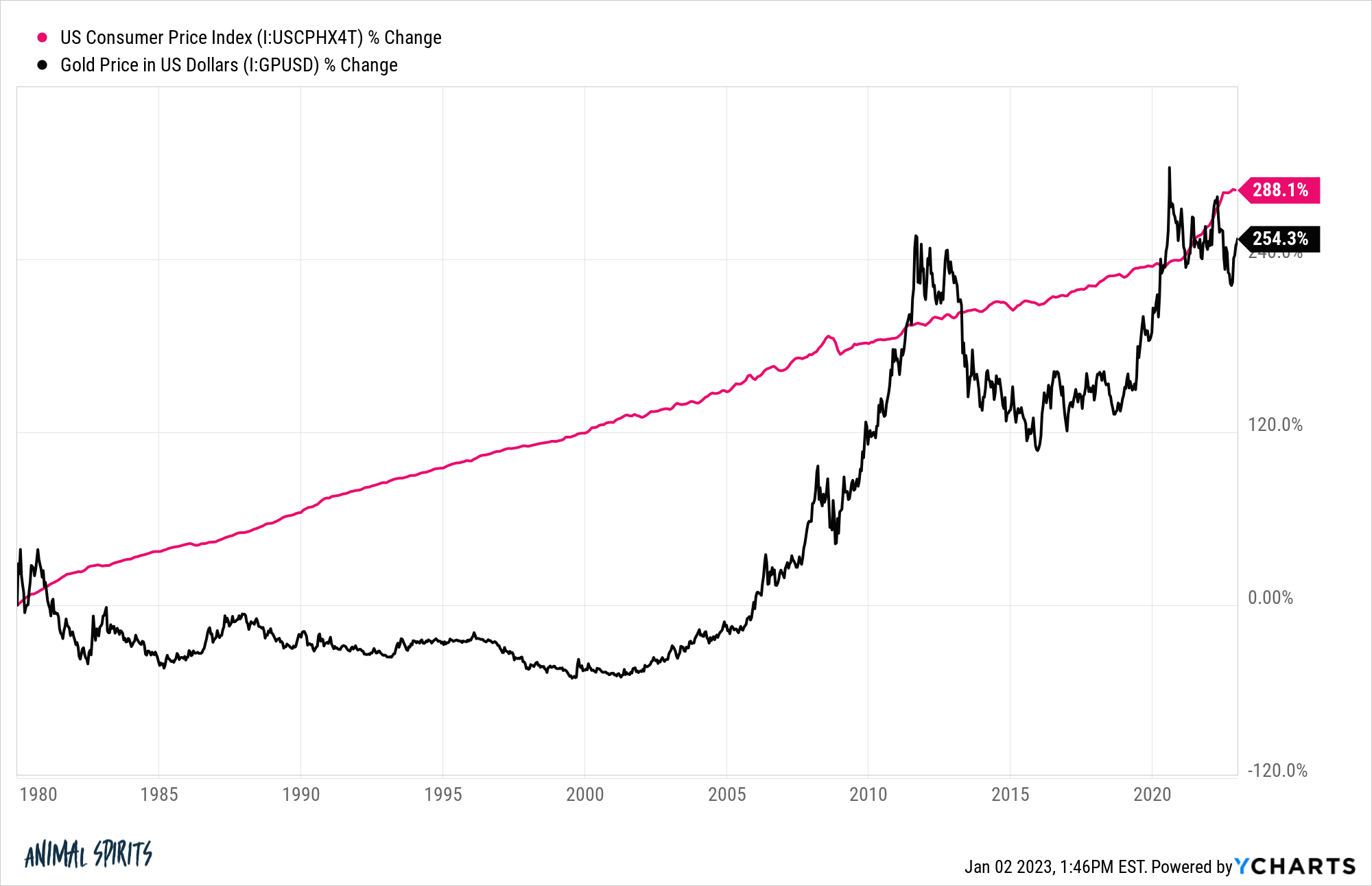

It’s exhausting to consider, however gold hasn’t outpaced inflation since 1980.

Actual returns will keep under their peak, however nominal ones don’t. Gold breaks out and makes a brand new excessive in 2023.

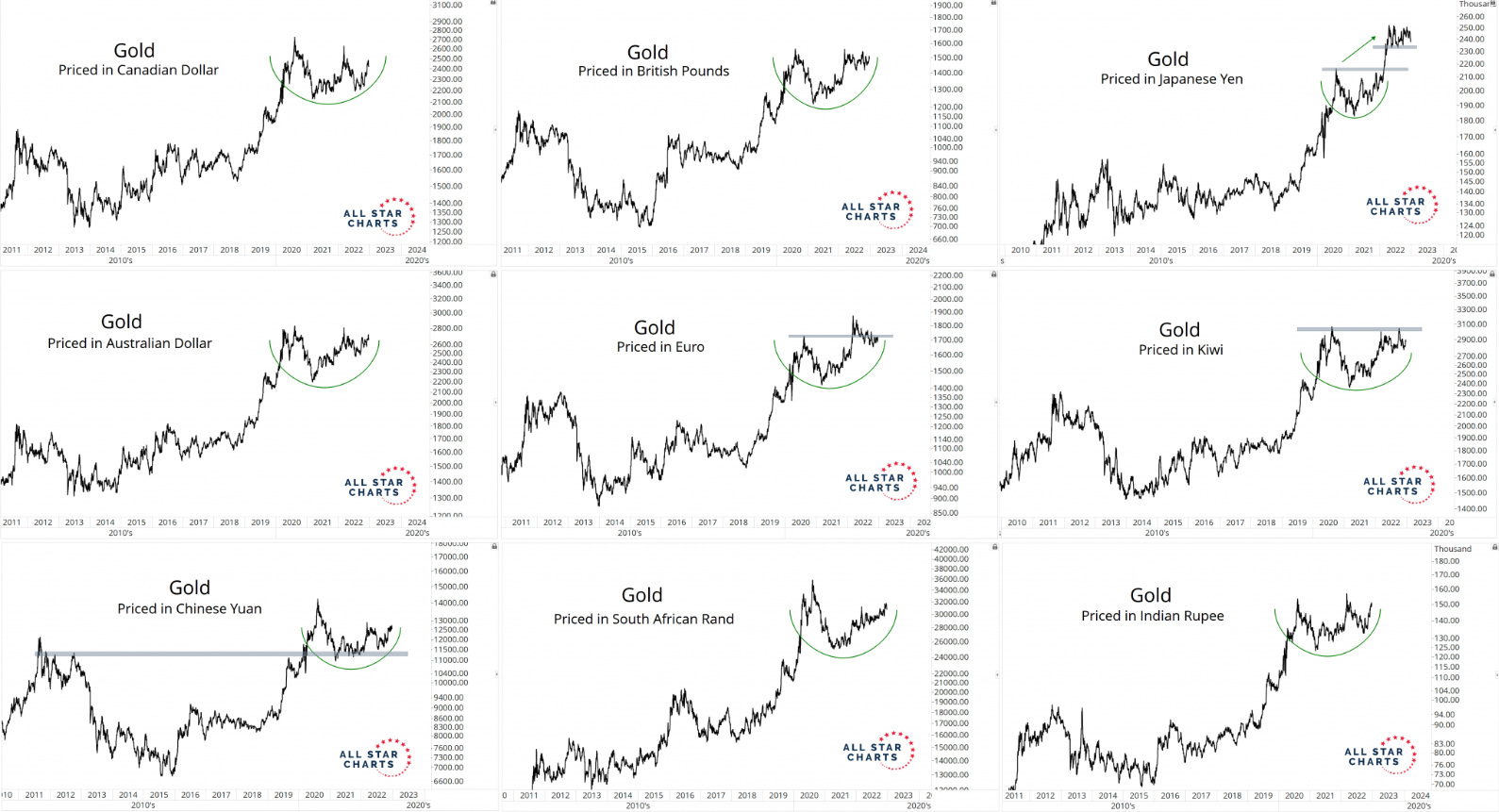

Gold has been appearing a lot better currently, ending 2022 at a six-month excessive. Gold has been disappointing throughout this inflationary surroundings, failing to maintain tempo with it since 2021. However that’s as a result of gold is priced in {dollars}, and the U.S. greenback has been on a tear. Should you take a look at gold versus different currencies, it seems to be even higher. These killer charts from JC paint a transparent image of the place the development is.

The Housing Market Doesn’t Crash

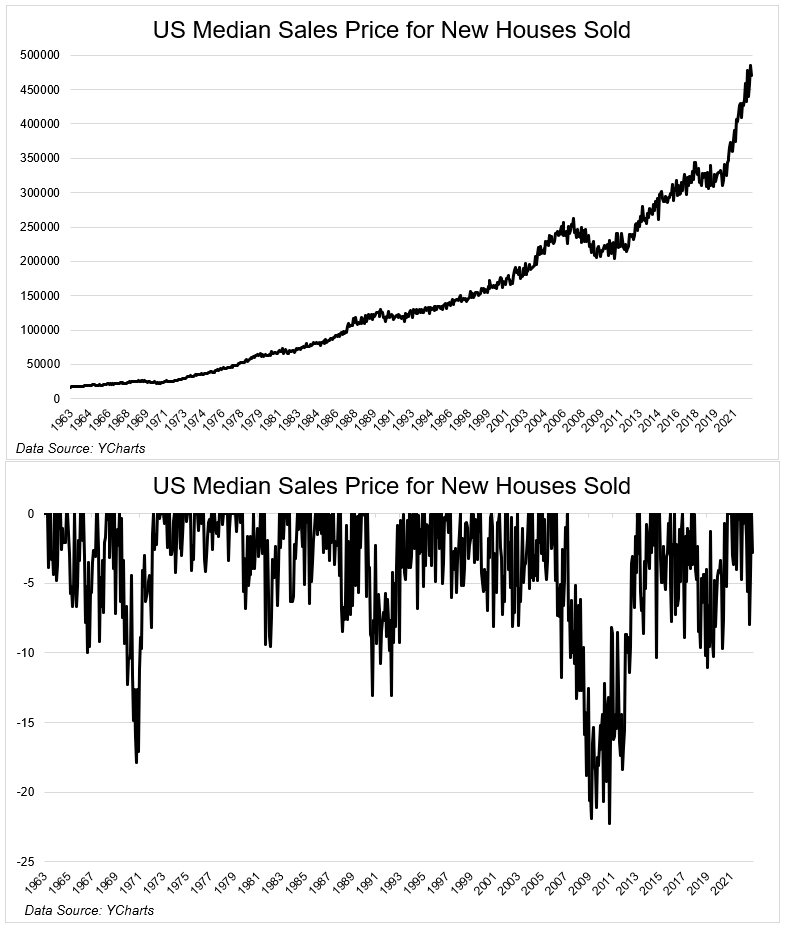

It will be straightforward to counsel {that a} large decline in house costs is underway. In spite of everything, for brand spanking new house gross sales to return to their common value in 2019, you’re speaking a couple of 32% decline, which might be deeper than what we noticed through the Nice Monetary Disaster.

However I don’t see that occuring. The availability-demand imbalance is structural, with consumers outnumbering sellers by lots. You see exercise selecting again up as rates of interest have are available over the previous couple of weeks. So long as charges don’t shoot again as much as 7%, house costs will cool, however they gained’t crash.

Worldwide Shares Outperform

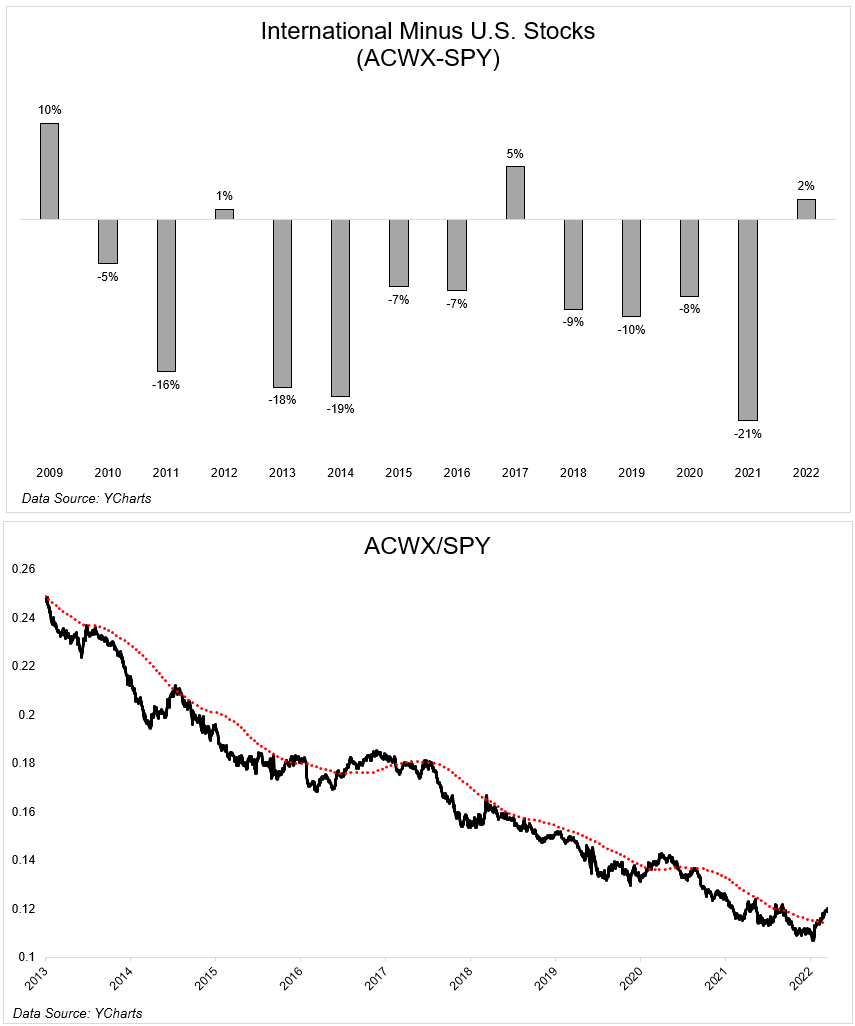

Diversifying away from U.S. shares has been very painful for a very long time. The S&P 500 has outperformed worldwide shares (ACWX) by 52% during the last 5 years and 160% during the last ten.

This would possibly shock you, however the S&P 500 truly underperformed many of the remainder of the world final yr, not less than in native currencies. However whenever you embrace the wrecking ball that was the greenback, the hole shrunk dramatically and reversed in some circumstances.

The S&P 500 has outperformed for eight of the final ten years. However with the greenback nicely off its highs and the extra value-oriented (much less tech-heavy) make-up of worldwide shares, search for them to have their greatest yr relative to the S&P 500 since 2009.

Technically, worldwide shares are beginning to look higher as nicely. The chart under reveals that the ACWX/SPY ratio is additional above its 200-day transferring common than at any level during the last decade.

Crypto doubles in 2023

It’s exhausting to make the bull case for an asset class that feels prefer it comes with profession threat. With all of the negativity surrounding the area proper now, I’m amazed that Bitcoin isn’t under 10k proper now. And possibly that’s what the bulls can grasp their hat/hopes on.

Bulls will say that we’ve been right here earlier than. Wanting on the drawdown chart, yea, costs have seen most of these declines earlier than.

However in each different decline, crypto was only a fringe asset. It nonetheless is, however what I imply. Like solely crypto natives skilled earlier drawdowns. So this time is extraordinarily completely different as a result of consumers who entered throughout the latest bull run have been worn out and, in lots of circumstances, won’t ever return.

Crypto is an asset that’s based mostly on perception and religion, and so they’re each at an all-time low. So how do you recreate a hype cycle after what we simply noticed? And with the overhang of no matter is occurring with DCG and the questions surrounding Binance, it’s exhausting to be bullish proper right here. Particularly with the fed persevering with to take away liquidity from the system. Proper now crypto is little greater than a excessive beta asset on steroids. Wait, did I predict that crytpo will get minimize in half once more, as a result of that’s what that is sounding like. Precisely!

No however for actual, this looks as if essentially the most unbelievable prediction on this checklist and one which few are positioned for. Crypto will double in 2023.

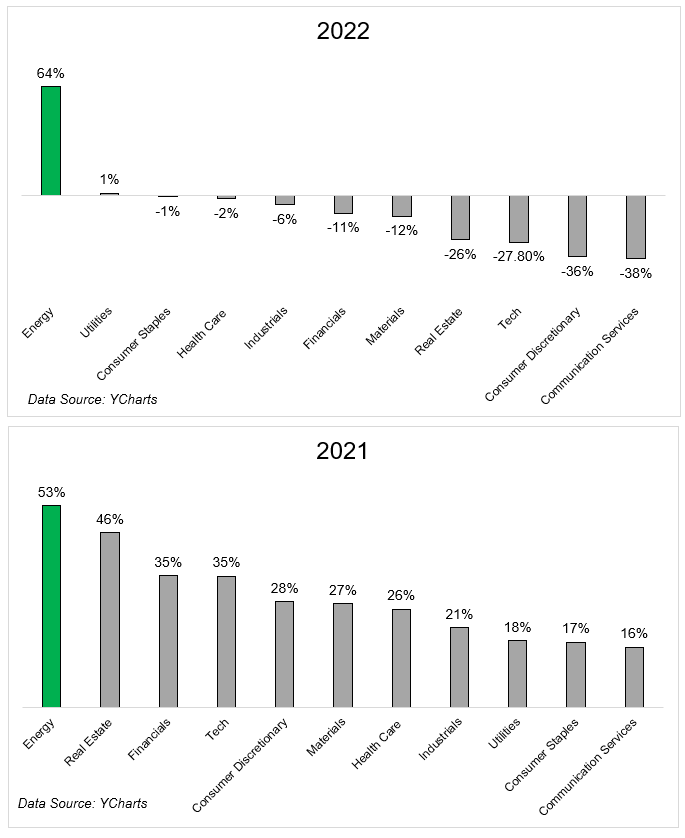

Vitality shares proceed to outperform

Vitality would be the first sector to threepeat since well being care in 1989-1991.

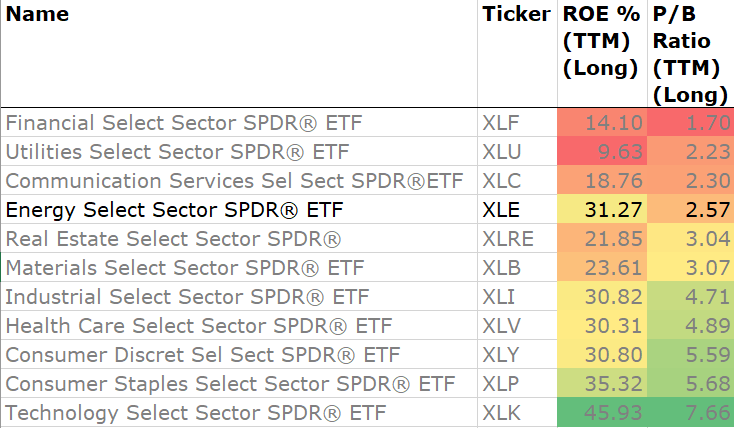

Regardless of the spectacular run, Daniel Sotiroff shared this chart displaying that vitality shares will not be solely extremely worthwhile however they’re additionally very low-cost.

Vitality shares, which fell under 2% of the general market at their lows, will end 2023 north of seven% (5.2% at the moment).

Bonus. The market avoids a recession, and shares achieve double digits.

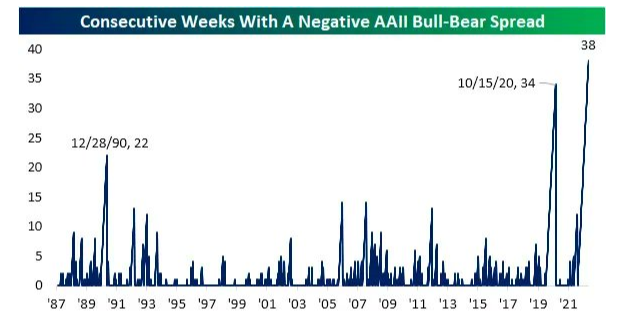

2023 will probably be very very similar to 2022 within the sense that macro will dominate. The most important threat is hiding in plain sight, and it’s the fed over tightening right into a softening financial system. With peak inflation hopefully behind us, a client that’s nonetheless in fine condition, and an investor class that’s destructive throughout the board, it wouldn’t take a lot in the way in which of an upside shock for shares to take off.

Predictions are solely foolish in case you take them critically. Particularly in case you take your personal predictions critically. These are my greatest guesses as to what occurs within the subsequent yr, and I look ahead to rereading them in twelve months in disbelief that I might be so improper on so many issues. I hope everyone has a contented, wholesome, secure, and affluent new yr.